State Farm auto insurance full coverage is one of the most popular choices for drivers seeking reliable and comprehensive protection. Whether you're a first-time car owner or a seasoned driver, understanding the intricacies of full coverage can help you make an informed decision. This guide will break down everything you need to know about State Farm's offerings, ensuring you're well-prepared to choose the right plan for your needs.

State Farm is one of the largest insurance providers in the United States, known for its extensive network, competitive pricing, and customer service. Full coverage insurance is essential for drivers who want maximum protection for their vehicles, covering damages, theft, and liability. This article will explore the various aspects of State Farm's full coverage plans, helping you understand the benefits and costs involved.

In today's world, having the right insurance coverage is crucial. Whether you're protecting your investment or ensuring compliance with state laws, State Farm's full coverage policy is designed to offer peace of mind. Let's dive deeper into what makes State Farm's full coverage a top choice for drivers nationwide.

Read also:Exploring The Miaz And Girthmaster Video A Comprehensive Guide

Table of Contents

- What is Full Coverage Auto Insurance?

- Benefits of Choosing State Farm for Full Coverage

- Types of Coverage Included in State Farm Full Coverage

- Factors Affecting the Cost of Full Coverage

- Available Discounts and Savings

- State Farm's Claims Process

- Customer Reviews and Testimonials

- Comparison with Other Providers

- Frequently Asked Questions

- Conclusion and Call to Action

What is Full Coverage Auto Insurance?

Full coverage auto insurance refers to a combination of insurance policies that provide comprehensive protection for your vehicle. Unlike basic liability insurance, which only covers damages to others, full coverage includes collision and comprehensive coverage, ensuring your car is protected against various risks.

Understanding Collision Coverage

Collision coverage is a crucial component of State Farm's full coverage policy. It covers damages to your vehicle resulting from collisions with other cars or objects. This coverage is especially important for newer vehicles, where repair costs can be significant.

Comprehensive Coverage Explained

Comprehensive coverage, on the other hand, protects your vehicle from non-collision-related incidents such as theft, vandalism, natural disasters, and animal-related accidents. State Farm ensures that policyholders are safeguarded against these unforeseen events, providing peace of mind for drivers nationwide.

Benefits of Choosing State Farm for Full Coverage

State Farm stands out as a leader in the insurance industry, offering numerous benefits to its customers. Here are some reasons why State Farm's full coverage policy is a top choice:

- Extensive Network: With over 19,000 agents nationwide, State Farm ensures easy access to customer support.

- Competitive Pricing: State Farm offers affordable rates without compromising on coverage quality.

- Excellent Customer Service: Known for its responsive and friendly service, State Farm prioritizes customer satisfaction.

Types of Coverage Included in State Farm Full Coverage

State Farm's full coverage policy includes several types of coverage to ensure comprehensive protection:

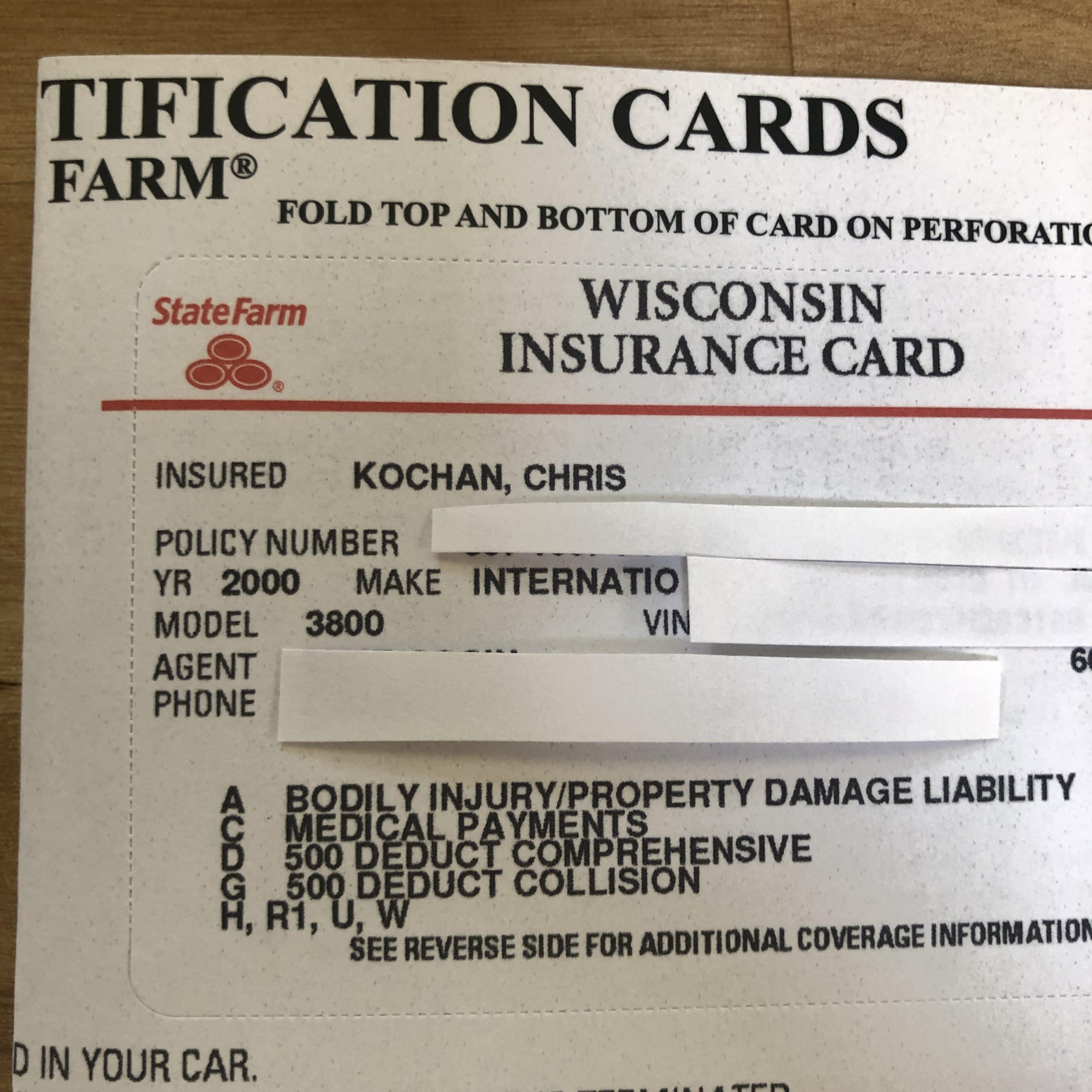

Liability Coverage

This coverage is mandatory in most states and protects you against damages or injuries caused to others in an accident. State Farm offers both bodily injury and property damage liability coverage, ensuring compliance with state laws.

Read also:Can Has Cheezburger The Ultimate Guide To Understanding And Exploring The Phenomenon

Uninsured/Underinsured Motorist Coverage

This coverage protects you in the event of an accident involving an uninsured or underinsured driver. State Farm ensures that policyholders are not left financially vulnerable in such situations.

Factors Affecting the Cost of Full Coverage

The cost of State Farm's full coverage policy can vary based on several factors:

- Vehicle Type: Luxury or high-performance vehicles typically have higher premiums due to increased repair costs.

- Driver's Age and Experience: Younger or less experienced drivers may face higher rates due to perceived higher risk.

- Location: Drivers in urban areas often pay more due to higher rates of accidents and theft.

Available Discounts and Savings

State Farm offers various discounts to help customers save on their full coverage premiums:

Safe Driver Discount

Drivers with a clean record can qualify for significant discounts. State Farm rewards safe driving habits by reducing premiums for policyholders with no accidents or violations.

Multipolicy Discount

Customers who bundle their auto insurance with other policies, such as homeowners or renters insurance, can enjoy substantial savings. State Farm encourages policy bundling to provide greater value to its customers.

State Farm's Claims Process

Filing a claim with State Farm is a straightforward process. The company offers multiple channels for submitting claims, including online, mobile app, or through a local agent. State Farm's claims process is designed to be efficient and customer-friendly, ensuring timely resolution of issues.

Steps to File a Claim

- Contact State Farm immediately after an incident occurs.

- Provide necessary details, such as accident reports and vehicle information.

- Work with a claims adjuster to assess damages and determine compensation.

Customer Reviews and Testimonials

State Farm has consistently received positive feedback from its customers. Many policyholders appreciate the company's prompt claims handling, competitive pricing, and exceptional customer service. Reviews on platforms like Trustpilot and Google highlight State Farm's commitment to quality and reliability.

Comparison with Other Providers

When comparing State Farm to other insurance providers, several factors come into play:

- Geico: Known for its affordability, Geico offers competitive rates but may lack the extensive network of State Farm.

- Progressive: Offers customizable options but may not match State Farm's customer service reputation.

Frequently Asked Questions

What Does Full Coverage Cover?

Full coverage typically includes collision, comprehensive, and liability coverage, ensuring protection against a wide range of risks.

Is Full Coverage Mandatory?

While liability coverage is mandatory in most states, full coverage is optional. However, it is often required by lenders if you have a car loan or lease.

Conclusion and Call to Action

State Farm auto insurance full coverage is a comprehensive solution for drivers seeking maximum protection for their vehicles. With its extensive network, competitive pricing, and excellent customer service, State Farm stands out as a top choice in the insurance industry. By understanding the various aspects of full coverage, you can make an informed decision that aligns with your needs and budget.

Take the first step toward securing your vehicle by contacting a State Farm agent today. Share your thoughts and experiences in the comments below, and don't forget to explore other informative articles on our website.

Data Source: State Farm Official Website